Facing Hardship or Missed Payments? I’m Here to Help.

Sometimes life can hit hard with unexpected challenges, leading to financial hardship and missed mortgage payments. But you don’t have to face this alone. As your Certified SFR (Short Sale and Foreclosure Resource) Realtor, I’m here to provide guidance and support through every step of the process, ensuring you understand your options and make informed decisions.

Before we get further, let’s define some of the terms that will be used throughout this journey.

Short Sale: A short sale occurs when a homeowner sells their property for less than the amount owed on the mortgage. The lender agrees to accept the reduced payoff amount to release the lien on the property.

Foreclosure: Foreclosure is the legal process by which a lender takes control of a property after the borrower fails to make mortgage payments.

Loan Servicer: A loan servicer manages the day-to-day administration of a loan, including collecting payments, managing escrow accounts, and handling delinquencies.

Loan Modification: A loan modification involves changing the terms of the existing loan to make payments more affordable for the borrower.

Notice of Default (NOD): A formal notice filed by the lender indicating that the borrower has defaulted on their mortgage payments.

Notice of Sale: A notice issued by the lender that the property will be sold at a public auction if the borrower does not cure the default.

Judgment Lien: A lien on the property granted to a creditor by a court judgment, which can be used to satisfy the debt owed.

How does the general process look in Virginia?

In Virginia, a non-judicial state, the foreclosure process uses a “Deed of Trust” instead of a mortgage. The general process is below:

1. Borrower (Trustor) defaults on the loan.

2. Trustee records a Notice of Default (NOD) and sends a copy to the borrower.

3. After the statutory period, a Notice of Sale is posted on the property.

4. The sale is advertised to the public.

5. If the borrower does not bring the account into good standing, the property is auctioned at a foreclosure sale.

Now that you understand some of the terms and the process – what are your options in Virginia when facing these hardships?

If You Want to Keep Your Property:

– Refinance: Obtain a new loan with better terms to pay off the existing mortgage.

– Lender Workout: Negotiate with the lender for a repayment plan or temporary payment reduction.

– Forbearance: Temporarily reduce or suspend mortgage payments.

– Loan Modification: Change the terms of your loan to make payments more affordable.

If You Cannot Stay in Your Property:

– Sell and Bring Cash to Closing: Sell the property and cover any shortfall at closing.

– Deed-in-Lieu of Foreclosure: Transfer ownership of the property to the lender to avoid foreclosure.

– Short Sale: Sell the property for less than the amount owed with the lender’s approval.

– Foreclosure: Allow the lender to take control of the property through the foreclosure process.

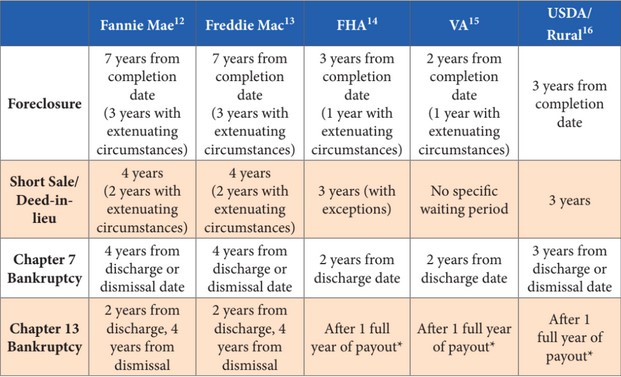

If these hardships occur and you’re looking to repurchase in the future, how does this affect your buying power? See below

Your future purchasing power depends on the type of loan and the path you take to resolve your current situation.

Every Situation is Unique

Everyone’s hardships, foreclosure, or short sale scenario is unique. It’s crucial to address your situation head-on and not ignore letters and notices. Seeking professional help as soon as possible puts you in the best position to navigate your options and find the best solution.

Contact me now so we can meet up and discuss your options. As an SFR (Short Sale and Foreclosure Resource) Certified professional, I am here to help you through this challenging time. Let’s work together to find the best solution for your situation.